Pembina Pipeline Corporation Reports Strong Results for the Second Quarter 2022, Raises Guidance and Provides Business and ESG Update

|

All financial figures are in Canadian dollars unless otherwise noted. This news release refers to certain financial measures and ratios that are not specified, defined or determined in accordance with Generally Accepted Accounting Principles ("GAAP"), including net revenue; adjusted earnings before interest, taxes, depreciation and amortization ("adjusted EBITDA"); adjusted cash flow from operating activities; and adjusted cash flow from operating activities per common share. For more information see "Non-GAAP and Other Financial Measures" herein. |

CALGARY, AB, Aug. 4, 2022 /CNW/ - Pembina Pipeline Corporation ("Pembina" or the "Company") (TSX: PPL) (NYSE: PBA) announced today its financial and operating results for the second quarter 2022.

Highlights

- Strong Quarterly Results – delivered earnings of $418 million and adjusted EBITDA of $849 million, the latter representing a record for a second quarter, reflecting higher natural gas liquids ("NGL") and crude oil prices and margins, and rising volumes on key systems.

- Guidance Raised – 2022 adjusted EBITDA guidance range has been increased to $3.575 to $3.675 billion (previously $3.45 to $3.6 billion).

- NEBC Producer Commitment – Pembina has executed the previously referenced long-term agreements with a third leading Northeast British Columbia ("NEBC") Montney producer, which include the commitment of significant volumes from another multi-phase NEBC Montney development.

- Alliance Recontracting – open seasons conducted during the second quarter further strengthened Alliance's contracting profile and continue to highlight the strong AECO-Chicago price differential and the value of Alliance's reliable and highly competitive access to mid-western U.S. gas markets, and as a conduit to the Gulf Coast and its robust liquified natural gas ("LNG") market.

- ESG – Pembina continues to advance execution of its environmental, social, and governance ("ESG") strategy with a $1 billion sustainability-linked revolving credit facility, a second renewable power purchase agreement ("PPA"), and meaningful progress on its equity, diversity, and inclusion ("EDI") targets.

Financial and Operational Overview

|

3 Months Ended June 30 |

6 Months Ended June 30 |

|||

|

($ millions, except where noted) |

2022 |

2021 |

2022 |

2021 |

|

Revenue |

3,095 |

1,902 |

6,133 |

3,918 |

|

Net revenue (1) |

1,020 |

894 |

2,174 |

1,893 |

|

Gross profit |

711 |

550 |

1,568 |

1,180 |

|

Earnings |

418 |

254 |

899 |

574 |

|

Earnings per common share – basic (dollars) |

0.70 |

0.39 |

1.51 |

0.91 |

|

Earnings per common share – diluted (dollars) |

0.69 |

0.39 |

1.50 |

0.91 |

|

Cash flow from operating activities |

604 |

584 |

1,259 |

1,040 |

|

Cash flow from operating activities per common share – basic (dollars) |

1.09 |

1.06 |

2.28 |

1.89 |

|

Adjusted cash flow from operating activities (1) |

683 |

538 |

1,383 |

1,120 |

|

Adjusted cash flow from operating activities per common share – basic (dollars)(1) |

1.23 |

0.98 |

2.50 |

2.04 |

|

Common share dividends declared |

349 |

347 |

696 |

693 |

|

Dividends per common share (dollars) |

0.63 |

0.63 |

1.26 |

1.26 |

|

Capital expenditures (3) |

152 |

146 |

331 |

273 |

|

Total volumes (mboe/d) (2) |

3,344 |

3,500 |

3,358 |

3,491 |

|

Adjusted EBITDA (1) |

849 |

778 |

1,854 |

1,613 |

|

(1) |

Refer to "Non-GAAP and Other Financial Measures". |

|

(2) |

Total revenue volumes. Revenue volumes are physical volumes plus volumes recognized from take-or-pay commitments. Volumes are stated in thousand barrels of oil equivalent per day ("mboe/d"), with natural gas volumes converted to mboe/d from millions of cubic feet per day ("MMcf/d") at a 6:1 ratio. |

|

(3) |

Includes capital expenditures related to assets held for sale of $6 million for the three and six months ended June 30, 2022. |

Financial and Operational Overview by Division

|

3 Months Ended June 30 |

6 Months Ended June 30 |

|||||||||||

|

2022 |

2021 |

2022 |

2021 |

|||||||||

|

($ millions, except where noted) |

Volumes(1) |

Reportable |

Adjusted |

Volumes(1) |

Reportable |

Adjusted |

Volumes(1) |

Reportable |

Adjusted |

Volumes(1) |

Reportable |

Adjusted |

|

Pipelines |

2,476 |

382 |

523 |

2,627 |

325 |

522 |

2,486 |

743 |

1,044 |

2,607 |

658 |

1,051 |

|

Facilities |

868 |

143 |

277 |

873 |

161 |

270 |

872 |

389 |

558 |

884 |

348 |

539 |

|

Marketing & New Ventures(3) |

— |

139 |

103 |

— |

9 |

38 |

— |

360 |

370 |

— |

76 |

128 |

|

Corporate |

— |

(149) |

(54) |

— |

(167) |

(52) |

— |

(344) |

(118) |

— |

(331) |

(105) |

|

Total |

3,344 |

515 |

849 |

3,500 |

328 |

778 |

3,358 |

1,148 |

1,854 |

3,491 |

751 |

1,613 |

|

(1) |

Volumes for Pipelines and Facilities divisions are revenue volumes, which are physical volumes plus volumes recognized from take-or-pay commitments. Volumes are stated in mboe/d, with natural gas volumes converted to mboe/d from MMcf/d at a 6:1 ratio. |

|

(2) |

Refer to "Non-GAAP and Other Financial Measures". |

|

(3) |

NGL volumes are excluded from Volumes to avoid double counting. Refer to "Marketing & New Ventures Division" in Pembina's Management's Discussion and Analysis dated August 4, 2022 for the three and six months ended June 30, 2022 for further information. |

For further details on the Company's significant assets, including definitions for capitalized terms used herein that are not otherwise defined, refer to Pembina's Annual Information Form for the year ended December 31, 2021 filed at www.sedar.com (filed with the U.S. Securities and Exchange Commission at www.sec.gov under Form 40-F) and on Pembina's website at www.pembina.com.

Financial & Operational Highlights

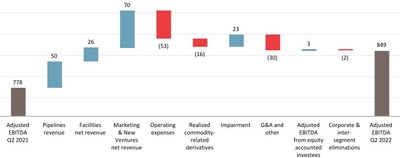

Adjusted EBITDA

Change in Second Quarter Adjusted EBITDA ($ millions)(1)

|

(1) Refer to "Non-GAAP and Other Financial Measures". |

In the second quarter, Pembina reported adjusted EBITDA of $849 million, representing a $71 million, or nine percent, increase over the same period in the prior year. Relative to the prior period, the second quarter was positively impacted by stronger marketing results due to higher margins on crude oil and NGL sales, a combination of higher volumes on the Peace Pipeline system and higher tolls due to inflation, and higher contributions from Aux Sable and Alliance. These positive factors were partially offset by a lower contribution from Ruby, due to Ruby Pipeline L.L.C. ("Ruby Pipeline") filing for bankruptcy protection on March 31, 2022; higher realized losses on commodity-related derivatives; lower contracted volumes on the Nipisi and Mitsue pipeline systems, due to the expiration of contracts; and higher general and administrative costs, primarily due to higher long-term incentive costs driven by Pembina's relative share price performance.

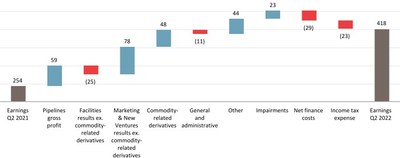

Earnings

Change in Second Quarter Earnings ($ millions)(1)(2)

|

(1) |

Facilities results ex. commodity-related derivatives and Marketing & New Ventures results ex. commodity-related derivatives include gross profit less realized and unrealized losses on commodity-related derivative financial instruments. |

|

(2) |

Other includes other expenses and corporate. |

Pembina recorded second quarter earnings of $418 million, representing a $164 million, or 65 percent, increase relative to the same period in the prior year. Relative to the prior period, in addition to the factors impacting adjusted EBITDA, as noted above, earnings in the second quarter were positively impacted by lower other expense and impairments and a higher unrealized gain on commodity-related derivatives. Second quarter earnings were negatively impacted by higher income tax expense, and higher net finance costs due to foreign exchange losses compared to gains in the second quarter of 2021.

Cash Flow From Operating Activities

Cash flow from operating activities of $604 million for the second quarter represents an increase of $20 million, or three percent, over the same period in the prior year. The increase was primarily driven by an increase in operating results after adjusting for non-cash items, higher distributions from equity accounted investees, and an increase in payments collected through contract liabilities, partially offset by changes in non-cash working capital, higher taxes paid, and higher net interest paid. On a per share (basic) basis, cash flow from operating activities increased by three percent due to the same factors.

Adjusted Cash Flow From Operating Activities

Adjusted cash flow from operating activities of $683 million represents a $145 million, or 27 percent, increase over the same period in the prior year. The increase was due to the factors impacting cash flow from operating activities, discussed above, excluding the impact of the change in non-cash working capital and taxes paid. On a per share (basic) basis, adjusted cash flow from operating activities increased by 26 percent due to the same factors.

Volumes

Total volumes of 3,344 mboe/d for the second quarter represent a decrease of approximately four percent over the same period in the prior year. The decrease was the result of lower volumes in both Pipelines and Facilities as discussed in Divisional Highlights below. Excluding the volume impact of contract expirations on the Nipisi and Mitsue pipeline systems and Ruby Pipeline entering bankruptcy protection, second quarter volumes would have increased approximately one percent over the same period in the prior year.

Divisional Highlights

- Pipelines reported adjusted EBITDA for the second quarter of $523 million, consistent with $522 million in the same period in the prior year. The second quarter was positively impacted by higher volumes and higher tolls on certain pipeline systems, higher share of profit from Alliance due to higher volumes resulting from a wider AECO-Chicago natural gas price differential, in combination with the sale of linepack inventory, and higher recognition of deferred revenue volumes on the Vantage Pipeline. These positive factors were offset by a lower contribution from Ruby, due to Ruby Pipeline filing for bankruptcy protection on March 31, 2022, and the expiration of contracts on the Nipisi and Mitsue pipeline systems.

Pipelines had reportable segment earnings before tax in the second quarter of $382 million, representing a $57 million, or 18 percent increase over the same period in the prior year. The increase was primarily due to the same items impacting adjusted EBITDA, discussed above, excluding the impact of a lower contribution from Ruby, as well as lower depreciation.

Pipelines volumes of 2,476 mboe/d in the second quarter represent a six percent decrease compared to the same period in the prior year. The decrease was largely driven by Ruby Pipeline filing for bankruptcy protection and lower contracted volumes on the Nipisi and Mitsue pipeline systems, due to contract expirations, combined with lower volumes on the Alberta Ethane Gathering System due to third party outages. These factors were partially offset by higher volumes on the Peace Pipeline system, Vantage Pipeline, Drayton Valley Pipeline, and Cochin Pipeline. Excluding the volume impact of contract expirations on the Nipisi and Mitsue pipeline systems and Ruby Pipeline entering bankruptcy protection, second quarter volumes would have increased approximately one percent over the same period in the prior year. - Facilities reported adjusted EBITDA of $277 million for the second quarter, representing a $7 million, or three percent, increase over the same period in the prior year. The second quarter was positively impacted by a realized gain on commodity-related derivatives and higher contracted volumes at the Cutbank Complex.

Facilities had reportable segment earnings before tax in the second quarter of $143 million, which represents an $18 million, or 11 percent, decrease over the same period in the prior year. In addition to the items impacting adjusted EBITDA, discussed above, the decrease is primarily due to an unrealized loss on commodity-related derivatives in the second quarter of 2022, compared to a gain in the same period in the prior year, related to certain gas processing fees that are tied to AECO prices, and higher depreciation, partially offset by a lower impairment charge.

Facilities volumes of 868 mboe/d in the second quarter represent a one percent decrease compared to the same period in the prior year. The quarterly decrease is largely due to lower volumes at the Saturn Complex as a result of scheduled maintenance, partially offset by higher contracted volumes at the Cutbank Complex. - Marketing & New Ventures reported second quarter adjusted EBITDA of $103 million, which represents a $65 million, or 171 percent, increase compared to the second quarter of 2021. Higher margins on crude oil and NGL sales, partially offset by a higher realized loss on commodity-related derivatives, combined with a higher contribution from Aux Sable due to a wider AECO-Chicago natural gas price differential and higher NGL margins, contributed to a significant increase in results for the marketing business relative to the same period in the prior year.

Marketing & New Ventures had second quarter reportable segment earnings before tax of $139 million, representing a $130 million increase over the same period in the prior year. In addition to the items impacting adjusted EBITDA, discussed above, the increase was due to an unrealized gain on commodity-related derivatives in the second quarter of 2022, compared to an unrealized loss on commodity-related derivatives in the same period in 2021.

Marketed NGL volumes of 176 mboe/d in the second quarter were largely consistent with the same period in the prior year.

Executive Overview & Business Update

Pembina once again delivered a strong quarterly result with adjusted EBITDA of $849 million, setting a record for a second quarter. While typically a lower contribution quarter given the seasonality in Pembina's NGL marketing business, the second quarter benefited from continued growth in volumes across many of Pembina's systems, higher NGL margins and a strong contribution from the crude oil marketing business. Further, Pembina is pleased to offer the following mid-year update and commentary on its business.

- Based on strong year-to-date results and the outlook for the remainder of the year, Pembina has raised its 2022 adjusted EBITDA guidance range to $3.575 to $3.675 billion (previously $3.45 to $3.6 billion). Relative to Pembina's previous guidance, the revised outlook for 2022 primarily reflects stronger marketing results, higher contributions from the Alliance and Cochin pipelines as well as certain assets in the gas services business, and the anticipated closing of the proposed transaction with KKR in August 2022.

- Year-to-date, Pembina has generated cash flow from operating activities of nearly $1.3 billion, which has been used to fund dividend payments and the capital program, with the excess used to repurchase common shares and reduce debt, thereby strengthening the Company's leverage metrics. Pembina remains committed to common share repurchases up to $350 million, subject to closing the Newco Transaction. Additional excess cash flow, if any, is expected to be used to reduce debt and position the Company for the future.

- Pembina recently announced that all regulatory approvals have been received in respect of the joint venture transaction with KKR combining their respective western Canadian natural gas processing assets into a single, new joint venture entity ("Newco") (the "Transaction"). With this key approval, Pembina, KKR, and Energy Transfer LP are working to satisfy the remaining conditions to close the Transaction, which is expected in August 2022. Consistent with Pembina and KKR's intention to divest upon announcing their joint venture, Pembina and KKR's global infrastructure funds will divest the 50 percent, non-operated interest in the Key Access Pipeline System, which will be contributed into Newco as part of the Transaction.

- In the Company's view, the potential opportunities within the Western Canadian Sedimentary Basin ("WCSB") remain underappreciated. Pembina continues to observe steady volume growth on key systems. Further, a positive outlook for additional future growth is being informed by a number of factors, including the sound financial position of Pembina's customers, price strength across all commodities in Pembina's value chain — crude oil, natural gas and NGL, the quality of WCSB formations such as the Montney and Duvernay, the development of LNG facilities on Canada's West Coast, the expansion of the Trans Mountain pipeline, and potential growth and diversification within Alberta's petrochemical sector. Overall, Pembina's outlook for meaningful medium-term volume growth in the WCSB remains unaltered.

- Pembina has now executed the previously referenced long-term agreements with a third leading NEBC Montney producer, Tourmaline Oil Corp. ("Tourmaline"), which include the commitment of significant volumes from another multi-phase NEBC Montney development. The agreements allow Tourmaline to call for future firm transportation and fractionation services on a take-or-pay basis as the acreage is developed. This most recent agreement, together with two other previously executed NEBC Montney service agreements, provide three leading Montney producers with certainty of transportation egress from this key area for their future development and access to the remainder of Pembina's integrated value chain, including fractionation and marketing services.

Pembina remains poised to benefit from a promising outlook for NEBC development. As a result of the long-term commitments under the three agreements, Pembina expects to have secured the transportation, fractionation, and marketing rights to a significant portion of forecasted future growth in the NEBC Montney, which collectively will support improved utilization of its existing assets as well as capital efficient expansion projects into the future. - Pembina continues to progress a multi-billion-dollar portfolio of potential growth projects, including most notably the Cedar LNG project and the Alberta Carbon Grid. Potential growth projects also include NEBC infrastructure solutions, NGL extraction facilities, cogeneration facilities, and expansions of various pipeline systems and facilities. In particular, with an increase in customer liquid commitments, specifically in NEBC, Pembina is currently engineering and evaluating up to an incremental 55,000 barrels per day ("bpd") of propane-plus fractionation capacity at the Pembina's Redwater Complex. The Redwater Complex allows for a capital efficient expansion due to existing feed/spec cavern storage, ownership of significant contiguous land holdings, and industry leading rail and pipeline connectivity. Significant existing infrastructure provides Pembina the flexibility to rightsize the incremental fractionation capacity to meet recently announced customer commitments, as well as incremental demand, in a de-risked, timely and cost-effective manner.

- The contracting of Alliance Pipeline continues to progress very well, highlighting the strong AECO-Chicago price differential and the value of Alliance's reliable and highly competitive access to mid-western U.S. gas markets, and as a conduit to the Gulf Coast and its robust LNG market. During the second quarter of 2022, Alliance offered three open seasons to the market. The largest of the open seasons resulted in approximately 270 mmcf/d of incremental long-term firm service, with a volume weighted average term of 15 years, commencing in November 2022. The other two open seasons were for short-term firm service. Recent open seasons have resulted in Alliance being contracted over 90 percent for both the current gas year, ending October 31, 2022, and the next gas year, ending October 31, 2023.

- Despite broader inflationary pressures across the global economy, Pembina continues to benefit from a variety of protections inherent in the business. First, many long-term agreements include inflation adjustment mechanisms in the toll structure and for short-term interruptible arrangements, there is an ability to periodically adjust tolls to market conditions. Second, the largest components of Pembina's operating costs are labour, power, and integrity and maintenance. The majority of Pembina's long-term contracts have provisions which allow Pembina to recover power costs, and in some cases, non-routine maintenance or integrity items. Third, as it relates to capital projects, line pipe for the Peace Pipeline Phase VIII Expansion ("Phase VIII") has been procured, and construction contracts have been structured to provide labour inflation protection. However, inflationary pressures may impact future growth projects, which may affect the viability and sanctioning of future projects. Finally, with respect to the balance sheet, as at June 30, approximately 95 percent of Pembina's outstanding debt carried fixed rates, and the weighted average term of the fixed-rate debt was approximately 13 years.

ESG Update

Sustainability-Linked Loan

As discussed in detail below under Financing Activity, Pembina has established a sustainability-linked loan, aligning its financing strategy with its ESG priorities. The facility contains pricing adjustments that reduce or increase borrowing costs based on Pembina's performance relative to a greenhouse gas ("GHG") emissions intensity reduction performance target. Previously, Pembina announced a target to reduce its GHG emissions intensity by 30 percent by 2030, relative to baseline 2019 levels. The specific terms of the new facility include annual intermediate targets that align with Pembina's trajectory towards its 2030 goal. Establishing this facility further highlights Pembina's ESG commitment and ongoing efforts to integrate ESG into Pembina's business and financing strategy. Effectively managing GHG emissions is a key issue for the energy sector, and of the highest importance to Pembina and its stakeholders, including capital providers.

Renewable Power Purchase Agreement

During the second quarter, Pembina entered into a power purchase agreement for 105 megawatts ("MW") of renewable energy and associated renewable attributes, with Wild Rose 2 Wind LP, a wholly owned subsidiary of Capstone Infrastructure Corporation ("Capstone"), over 15-years from Capstone's 192 MW Wild Rose 2 Wind Farm, currently in development.

Pembina is pleased to be working with Capstone on their project and furthering the Company's sustainability goals. Pembina views power purchase agreements as an effective tool to support development of renewable energy infrastructure, lower emissions, and support the transition to a lower carbon energy system. The PPA with Capstone also benefits Pembina by securing cost-competitive renewable energy and fixing the price for a portion of the power Pembina consumes.

The PPA with Capstone supplements the previously announced PPA with a subsidiary of TransAlta Corporation at the Garden Plain Wind Project. The total amount of renewable power to be purchased annually under the two PPAs represents approximately 30 percent of Pembina's 2020 power consumption and Pembina expects to receive emission offsets for a total of approximately 3.7 million tonnes of carbon dioxide ("CO2") equivalent. Pembina has the option to use the offsets to reduce its own emissions or monetize the offsets to third parties.

Equity, Diversity, and Inclusion Progress

Further to Pembina's ESG strategy, Pembina continues to demonstrate its commitment to equity, diversity, and inclusion in the workplace. In an effort to increase the representation of women and other underrepresented groups at all levels of the organization, including the board of directors, Pembina previously announced the EDI targets shown below and is pleased to provide an update on its progress towards those targets.

|

Target |

Current Status |

|

|

Women in the workforce (1), (2) |

35 percent by 2025 |

26 percent |

|

Women in executive leadership (1) |

30 percent by 2022 |

35 percent |

|

Overall diversity in the workforce (2), (3) |

45 percent by 2025 |

40 percent |

|

Overall diversity in executive leadership (1) |

40 percent by 2025 |

39 percent |

|

Gender diversity of board representation |

At least 30 percent |

42 percent |

|

Independent directors belonging to one of the four designated groups in the Employment Equity Act (Canada): Indigenous persons, people with disabilities, people who are visible minorities, and women |

At least 40 percent |

45 percent |

|

(1) As at May 31, 2022. |

|

(2) Metric calculated based on Canadian employees only at this time. |

|

(3) As at May 6, 2022. |

Pembina established EDI targets because it believes that a diverse and inclusive workplace increases its long-term value and resilience. Over the past year, Pembina has made tremendous progress toward its goals, including expanding representation in executive leadership roles, both at the Vice President and Senior Vice President levels, and also on the board. The Company is well positioned to deliver on its targets and broader EDI initiatives are enabling Pembina to create a safe and inclusive workplace and attract and retain a broad and diverse talent pool at all levels of the organization.

Projects and New Developments

Pipelines

- The Phase VII Peace Pipeline Expansion ("Phase VII") was completed approximately $150 million under budget and was placed into service on June 1, 2022. Phase VII was constructed to provide transportation for the growing condensate supply in the WCSB and will divert condensate off of the existing LaGlace-Kakwa-Fox Creek corridor, creating additional firm capacity for Pembina's customers.

The volumes tied to the contracts underpinning Phase VII began flowing on an interruptible basis in advance of the in-service date using existing spare capacity on the Peace Pipeline system, and therefore were largely reflected in Pembina's second quarter 2022 financial results. In addition to allowing for increased product segregation across the Peace Pipeline system, the incremental benefit of Phase VII and the Phase IX Peace Pipeline Expansion ("Phase IX"), discussed below, will continue to be realized going forward as these expansions are designed to alleviate system constraints and create additional segment capacity to enhance Pembina's customer service offering and accommodate future growth. - During the second quarter, Pembina reactivated the previously deferred Phase VIII Peace Pipeline Expansion. Phase VIII will enable segregated pipeline service for ethane-plus and propane-plus NGL mix from Gordondale, Alberta, which is centrally located within the Montney trend, into the Edmonton area for market delivery. The project includes new 10-inch and 16-inch pipelines, totaling approximately 150 km, in the Gordondale to La Glace corridor of Alberta, as well as new mid-point pump stations and terminal upgrades located throughout the Peace Pipeline system. Phase VIII will add approximately 235,000 bpd of incremental capacity between Gordondale, Alberta and La Glace, Alberta, as well as approximately 65,000 bpd of capacity between La Glace, Alberta and the Namao hub near Edmonton, Alberta.

The project has an estimated cost of approximately $530 million, which relative to the original $500 million cost estimate, reflects additional capital compared to the original scope, including $90 million of infrastructure previously removed out of Phase VII. Further, the revised cost estimate reflects the net positive effect of cost savings arising from contracting strategies and value engineering over cost increases due to market factors. Approximately $75 million had been spent on this project at the end of 2021, with an incremental $65 million expected to be spent in 2022.

Engineering and procurement activities are underway and Phase VIII is trending on-time and on-budget with an expected in-service date in the first half of 2024. - Phase IX includes new 6-inch and 16-inch pipelines debottlenecking the corridor north of Gordondale, Alberta as well as upgrades at one pump station. In addition, this expansion will see existing pipelines, which are currently batching, converted to single product lines. Phase IX also includes a pump station in the Wapiti-to-Kakwa corridor that was previously part of the Phase VII project scope. Construction of the Wapiti-to-Kakwa pump station was completed in July 2022. Further, clearing activities are complete and mainline pipeline construction commenced in June as planned. Phase IX remains on-time and on-budget with an estimated cost of approximately $120 million and an expected in-service date in the fourth quarter of 2022.

Facilities

- The Empress Cogeneration Facility will use natural gas to generate up to 45 megawatts of electrical power, thereby reducing overall operating costs by providing electricity and heat to the existing Empress NGL Extraction Facility. All the power will be consumed on site, thereby supplying up to 90 percent of the site's electrical requirements. Further, this project will contribute to annual GHG reductions at the Empress NGL Extraction Facility through the utilization of the cogeneration waste heat and the low-emission power generated. Pembina anticipates a reduction of approximately 90,000 tonnes of CO2 equivalent per year based on the current energy demand of the Empress NGL Extraction Facility. Construction is progressing, with the electrical contractor finishing their scope of work and commissioning activities underway. The project is trending on budget with an estimated cost of approximately $120 million, and is now anticipated to come into service ahead of schedule in the third quarter of 2022, compared to its original in-service date in the fourth quarter of 2022.

Marketing & New Ventures

- Pembina and TC Energy Corporation ("TC Energy") intend to develop the Alberta Carbon Grid ("ACG"), a world-leading carbon transportation and sequestration platform that will enable Alberta-based industries to effectively manage their GHG emissions, contribute positively to Alberta's current and future lower-carbon economy, and create sustainable long-term value for Pembina and TC Energy stakeholders. During the first quarter of 2022, the Government of Alberta announced that ACG was successfully chosen to move to the next stage of the province's carbon capture utilization and storage process in the industrial heartland. During the second quarter, Pembina and TC Energy progressed discussions with the Government of Alberta, surface and sub-surface engineering and planning, and engagement with customers and stakeholders. Pembina and TC Energy are exploring options to potentially create several hubs throughout the province to gather and store CO2 safely and cost-effectively from multiple industries. Pembina's and TC Energy's long-term vision is to annually transport and store up to 20 million tonnes of CO2 through several hubs across Alberta.

- Pembina has formed a partnership with the Haisla First Nation to develop the proposed Cedar LNG Project, a floating LNG facility strategically positioned to leverage Canada's abundant natural gas supply and British Columbia's growing LNG infrastructure to produce industry-leading low carbon, low-cost Canadian LNG for overseas markets. Cedar LNG's application for an Environmental Assessment Certificate was submitted to the British Columbia Environmental Assessment Office in February of 2022 and is currently under review. Front End Engineering Design activities and commercial discussions with a diverse group of potential customers are both underway. Through ongoing commercial discussions, there is considerable interest to get WCSB natural gas to international markets, while at the same time diversifying to new supply sources.

Financing Activity

- During the second quarter of 2022, 1.4 million common shares were repurchased for cancellation under Pembina's normal course issuer bid ("NCIB") at an average price of $48.30 per share and a total cost of approximately $66 million. An additional 0.3 million common shares, at a total cost of approximately $11 million, were repurchased under the NCIB subsequent to the second quarter, in July. Pembina has now repurchased 2.7 million common shares, at a total cost of approximately $122 million, since late 2021.

- Subsequent to the quarter, on July 27, 2022, Pembina replaced its $2.5 billion revolving credit facility (the "Revolving Facility") with two credit facilities: an unsecured $1 billion sustainability-linked revolving credit facility (the "SLL Credit Facility") that has a term of four years, maturing June 2026 and an amendment and restatement of the Revolving Facility into an unsecured $1.5 billion revolving credit facility, which includes a $750 million accordion feature and matures in June 2027 (the "New Revolving Facility"). The SLL Credit Facility contains pricing adjustments that reduce or increase borrowing costs based on Pembina's performance relative to a GHG emissions intensity reduction performance target. With the exception of the sustainability-linked adjustments to borrowing costs, the terms and conditions of the SLL Credit Facility and the New Revolving Facility, including financial covenants, are substantially similar to each other and are substantially similar to the Revolving Facility.

Dividends

- Pembina declared and paid dividends of $0.21 per common share in April, May and June 2022 for the applicable record dates.

- In connection with the Newco Transaction with KKR, upon closing, and subject to approval and declaration by its Board of Directors, Pembina intends to increase its common share dividend by $0.0075 per share per month, or 3.6 percent. The increase, if implemented, would reflect the expected immediate cash flow accretion from creation of the joint venture.

- Pembina declared and paid quarterly dividends per Class A Preferred Share of: Series 1: $0.306625; Series 3: $0.279875; Series 5: $0.285813; Series 7: $0.27375; Series 9: $0.268875; and Series 21: $0.30625 to shareholders of record as of May 2, 2022. Pembina also declared and paid quarterly dividends per Class A Preferred Share of: Series 15: $0.279; Series 17: $0.301313; and Series 19: $0.29275 to shareholders of record on June 15, 2022. Pembina also declared and paid quarterly dividends per Class A Preferred Share of Series 23: $0.328125; and Series 25: $0.325 to shareholders of record on May 2, 2022.

Second Quarter 2022 Conference Call & Webcast

Pembina will host a conference call on Friday, August 5, 2022, at 8:00 a.m. MT (10:00 a.m. ET) for interested investors, analysts, brokers and media representatives to discuss results for the second quarter of 2022. The conference call dial-in numbers for Canada and the U.S. are 1-647-792-1240 or 1-800-437-2398. A recording of the conference call will be available for replay until August 12, 2022, at 11:59 p.m. ET. To access the replay, please dial either 1-647-436-0148 or 1-888-203-1112 and enter the password 3331229.

A live webcast of the conference call can be accessed on Pembina's website at www.pembina.com under Investors / Presentation & Events, or by entering:

https://produceredition.webcasts.com/starthere.jsp?ei=1501654&tp_key=8352814379 in your web browser. Shortly after the call, an audio archive will be posted on the website for a minimum of 90 days.

About Pembina

Pembina Pipeline Corporation is a leading energy transportation and midstream service provider that has served North America's energy industry for more than 65 years. Pembina owns an integrated network of hydrocarbon liquids and natural gas pipelines, gas gathering and processing facilities, oil and natural gas liquids infrastructure and logistics services, and a growing export terminals business. Through our integrated value chain, we seek to provide safe and reliable infrastructure solutions which connect producers and consumers of energy across the world, support a more sustainable future and benefit our customers, investors, employees and communities. For more information, please visit www.pembina.com.

Purpose of Pembina:

To be the leader in delivering integrated infrastructure solutions connecting global markets:

- Customers choose us first for reliable and value-added services;

- Investors receive sustainable industry-leading total returns;

- Employees say we are the 'employer of choice' and value our safe, respectful, collaborative and inclusive work culture; and

- Communities welcome us and recognize the net positive impact of our social and environmental commitment.

Pembina is structured into three Divisions: Pipelines Division, Facilities Division and Marketing & New Ventures Division.

Pembina's common shares trade on the Toronto and New York stock exchanges under PPL and PBA, respectively. For more information, visit www.pembina.com.

Forward-Looking Statements and Information

This document contains certain forward-looking statements and forward-looking information (collectively, "forward-looking statements"), including forward-looking statements within the meaning of the "safe harbor" provisions of applicable securities legislation, that are based on Pembina's current expectations, estimates, projections and assumptions in light of its experience and its perception of historical trends. In some cases, forward-looking statements can be identified by terminology such as "continue", "anticipate", "schedule", "will", "expects", "estimate", "potential", "planned", "future", "outlook", "strategy", "protect", "trend", "commit", "maintain", "focus", "ongoing", "believe" and similar expressions suggesting future events or future performance.

In particular, this document contains forward-looking statements, including certain financial outlooks, pertaining to, without limitation, the following: Pembina's corporate strategy and the development of new business initiatives and growth opportunities, including the anticipated benefits therefrom and the expected timing thereof; expectations about industry activities and development opportunities, including operating segment outlooks and general market conditions for 2022 and thereafter; expectations about future demand for Pembina's infrastructure and services; expectations relating to new infrastructure projects, including the benefits therefrom and timing thereof; Pembina's sustainability, climate change and environmental, social and governance plans, initiatives and strategies, including expectations relating to Pembina's GHG emissions reduction target, and the anticipated benefits thereof; Pembina's revised 2022 annual guidance, including the Company's expectations regarding its adjusted EBITDA; expectations relating to the joint venture transaction between Pembina and KKR, including the terms thereof, the assets to be contributed by Pembina and KKR, the expected closing date and the anticipated benefits thereof to Pembina; Pembina's future common share dividends, including Pembina's intention to increase the amount thereof following closing of the joint venture transaction with KKR; planning, construction and capital expenditure estimates, schedules and locations; expected capacity, incremental volumes, completion and in-service dates; rights, activities and operations with respect to the construction of, or expansions on, existing pipelines systems, gas services facilities, processing and fractionation facilities, terminalling, storage and hub facilities and other facilities or energy infrastructure, as well as the impact of Pembina's growth projects on its future financial performance and stakeholders; expectations regarding Pembina's commercial agreements, including the expected timing and benefit thereof; statements regarding the Company's intention to repurchase common shares; expectations, decisions and activities related to the Company's projects and new developments; the impact of current and expected market conditions on Pembina; expectations regarding the Company's ability to return capital to shareholders; and statements regarding the Company's capital allocation strategy, including the revised 2022 capital expenditure program and expected future cash flows.

The forward-looking statements are based on certain assumptions that Pembina has made in respect thereof as at the date of this news release regarding, among other things: oil and gas industry exploration and development activity levels and the geographic region of such activity; the success of Pembina's operations; prevailing commodity prices, interest rates, carbon prices, tax rates and exchange rates; the ability of Pembina to maintain current credit ratings; the availability of capital to fund future capital requirements relating to existing assets and projects; future operating costs; geotechnical and integrity costs; that any third-party projects relating to Pembina's growth projects will be sanctioned and completed as expected; the ability of Pembina and KKR to satisfy the conditions to closing of the joint venture transaction in a timely manner and substantially on the terms described herein; the ability of Newco to satisfy the conditions to closing of the acquisition of the remaining 51% interest in ETC in a timely manner and substantially on the terms described herein; that any required commercial agreements can be reached; that all required regulatory and environmental approvals can be obtained on the necessary terms and in a timely manner; that counterparties will comply with contracts in a timely manner; that there are no unforeseen events preventing the performance of contracts or the completion of the relevant projects; prevailing regulatory, tax and environmental laws and regulations; maintenance of operating margins; the amount of future liabilities relating to lawsuits and environmental incidents; and the availability of coverage under Pembina's insurance policies (including in respect of Pembina's business interruption insurance policy).

Although Pembina believes the expectations and material factors and assumptions reflected in these forward-looking statements are reasonable as of the date hereof, there can be no assurance that these expectations, factors and assumptions will prove to be correct. These forward-looking statements are not guarantees of future performance and are subject to a number of known and unknown risks and uncertainties including, but not limited to: the regulatory environment and decisions and Indigenous and landowner consultation requirements; the impact of competitive entities and pricing; reliance on third parties to successfully operate and maintain certain assets; labour and material shortages; reliance on key relationships and agreements; the strength and operations of the oil and natural gas production industry and related commodity prices the ability of Pembina and KKR to satisfy, in a timely manner, the other conditions to the closing of the joint venture transaction; the failure to realize the anticipated benefits and/or synergies of the joint venture transaction following closing due to integration issues or otherwise; expectations and assumptions concerning, among other things: customer demand for Newco's assets and services; non-performance or default by counterparties to agreements which Pembina or one or more of its affiliates has entered into in respect of its business; adverse actions by governmental or regulatory authorities, including changes in tax laws and treatment, changes in project assessment regulations, royalty rates, climate change initiatives or policies or increased environmental regulation; the ability of Pembina to acquire or develop the necessary infrastructure in respect of future development projects; fluctuations in

operating results; adverse general economic and market conditions in Canada, North America and Internationally, including changes, or prolonged weaknesses, as applicable, in interest rates, foreign currency exchange rates, commodity prices, supply/demand trends and overall industry activity levels; risks related to the current and potential adverse impacts of the COVID-19 pandemic; constraints on the, or the unavailability of, adequate infrastructure; the political environment in North American and elsewhere, and public opinion; the ability to access various sources of debt and equity capital, and on acceptable terms; adverse changes in credit ratings; counterparty credit risk; technology and cyber security risks; natural catastrophes; the conflict between Ukraine and Russia and its potential impact on, among other things, global market conditions and supply and demand, energy and commodity prices; interest rates, supply chains and the global economy generally; and certain other risks detailed in Pembina's Annual Information Form and Management's Discussion and Analysis, each dated February 24, 2022 for the year ended December 31, 2021 and from time to time in Pembina's public disclosure documents available at www.sedar.com, www.sec.gov and through Pembina's website at www.pembina.com. In addition, the closing of the joint venture transaction may not be completed or may be delayed if Pembina's and KKR's respective conditions to the closing are not satisfied on the anticipated timelines or at all. Accordingly, there is a risk that the joint venture transaction will not be completed within the anticipated timeline, on the terms currently proposed and disclosed in this news release or at all.

In respect of the forward-looking statements concerning the anticipated increase in Pembina's common dividend following completion of the joint venture transaction with KKR, Pembina has made such forward-looking statements in reliance on certain assumptions that it believes are reasonable at this time, including assumptions in respect of: prevailing commodity prices, interest rates, margins and exchange rates; that future results of operations will be consistent with past performance, as applicable, and management expectations in relation thereto, including in respect of Newco's future results of operations; the continued availability of capital at attractive prices to fund future capital requirements relating to existing assets and projects,

including, but not limited to, future capital expenditures relating to expansion, upgrades and maintenance shutdowns; future cash flows and operating costs; that counterparties to material agreements will continue to perform in a timely manner; that there are no unforeseen events preventing the performance of contracts; that there are no unforeseen material construction or other costs related to current growth projects or current operations; and that there are no unforeseen material construction or other costs related to current growth projects or current operations. Pembina will also be subject to requirements under applicable corporate laws in respect of declaring dividends at such time.

This list of risk factors should not be construed as exhaustive. Readers are cautioned that events or circumstances could cause results to differ materially from those predicted, forecasted or projected by forward-looking statements contained herein. The forward-looking statements contained in this document speak only as of the date of this document. Pembina does not undertake any obligation to publicly update or revise any forward-looking statements or information contained herein, except as required by applicable laws. Management approved the revised 2022 adjusted EBITDA guidance contained herein as of the date of this news release. The purpose of the revised 2022 adjusted EBITDA guidance is to assist readers in understanding Pembina's expected and targeted financial results, and this information may not be appropriate for other purposes. The forward-looking statements contained in this document are expressly qualified by this cautionary statement.

Non-GAAP and Other Financial Measures

Throughout this news release, Pembina has disclosed certain financial measures and ratios that are not defined in accordance with GAAP and which are not disclosed in Pembina's financial statements. Non-GAAP financial measures either exclude an amount that is included in, or include an amount that is excluded from, the composition of the most directly comparable financial measure determined in accordance with GAAP. Non-GAAP ratios are financial measures that are in the form of a ratio, fraction, percentage or similar representation that has a non-GAAP financial measure as one or more of its components. These non-GAAP financial measures and ratios are used by management to evaluate the performance and cash flows of Pembina and its businesses and to provide additional useful information respecting Pembina's financial performance and cash flows to investors and analysts.

In this news release, Pembina has disclosed the following non-GAAP financial measures and non-GAAP ratios: net revenue, adjusted earnings before interest, taxes, depreciation and amortization ("adjusted EBITDA"), adjusted cash flow from operating activities, and adjusted cash flow from operating activities per common share. These non-GAAP financial measures and ratios disclosed in this news release do not have any standardized meaning under International Financial Reporting Standards ("IFRS") and may not be comparable to similar financial measures or ratios disclosed by other issuers. The measures and ratios should not, therefore, be considered in isolation or as a substitute for, or superior to, measures of Pembina's financial performance, or cash flows specified, defined or determined in accordance with IFRS, including revenue, earnings, cash flow from operating activities and cash flow from operating activities per share.

Except as otherwise described herein, these non-GAAP financial measures and non-GAAP ratios are calculated on a consistent basis from period to period. Specific reconciling items may only be relevant in certain periods.

Below is a description of each non-GAAP financial measure and non-GAAP ratio disclosed in this news release, together with, as applicable, disclosure of the most directly comparable financial measure that is determined in accordance with GAAP to which each non-GAAP financial measure relates and a quantitative reconciliation of each non-GAAP financial measure to such directly comparable GAAP financial measure. Additional information relating to such non-GAAP financial measures, including disclosure of the composition of each non-GAAP financial measure, an explanation of how each non-GAAP financial measure provides useful information to investors and the additional purposes, if any, for which management uses each non-GAAP financial measure; an explanation of the reason for any change in the label or composition of each non-GAAP financial measure from what was previously disclosed; and a description of any significant difference between forward-looking non-GAAP financial measures and the equivalent historical non-GAAP financial measures, is contained in the "Non-GAAP & Other Financial Measures" section of the management's discussion and analysis of Pembina dated August 4, 2022 for the three and six months ended June 30, 2022 (the "MD&A"), which information is incorporated by reference in this news release. The MD&A is available on SEDAR at www.sedar.com, EDGAR at www.sec.gov and Pembina's website at www.pembina.com.

Net Revenue

Net revenue is a non-GAAP financial measure which is defined as total revenue less cost of goods sold including product purchases. The most directly comparable financial measure to net revenue that is determined in accordance with GAAP and disclosed in Pembina's financial statements is revenue.

|

3 Months Ended June 30 |

Pipelines |

Facilities |

Marketing & New Ventures |

Corporate & Inter-segment |

Total |

|||||

|

($ millions) |

||||||||||

|

2022 |

2021 |

2022 |

2021 |

2022 |

2021(1) |

2022 |

2021 |

2022 |

2021(1) |

|

|

Revenue |

604 |

554 |

360 |

334 |

2,300 |

1,163 |

(169) |

(149) |

3,095 |

1,902 |

|

Cost of goods sold, including product purchases |

— |

— |

2 |

2 |

2,157 |

1,098 |

(84) |

(92) |

2,075 |

1,008 |

|

Net revenue |

604 |

554 |

358 |

332 |

143 |

65 |

(85) |

(57) |

1,020 |

894 |

|

(1) Comparative 2021 period has been restated. See "Accounting Policies & Estimates - Restatement of revenue and cost of goods sold" section in Pembina's MD&A and Note 15 to Pembina's Interim Financial Statements for further details. |

|

6 Months Ended June 30 |

Pipelines |

Facilities |

Marketing & New Ventures |

Corporate & Inter-segment |

Total |

|||||

|

($ millions) |

||||||||||

|

2022 |

2021 |

2022 |

2021 |

2022 |

2021(1) |

2022 |

2021 |

2022 |

2021(1) |

|

|

Revenue |

1,177 |

1,107 |

717 |

673 |

4,571 |

2,434 |

(332) |

(296) |

6,133 |

3,918 |

|

Cost of goods sold, including product purchases |

— |

— |

2 |

6 |

4,124 |

2,195 |

(167) |

(176) |

3,959 |

2,025 |

|

Net revenue |

1,177 |

1,107 |

715 |

667 |

447 |

239 |

(165) |

(120) |

2,174 |

1,893 |

|

(1) Comparative 2021 period has been restated. See "Accounting Policies & Estimates - Restatement of revenue and cost of goods sold" section in Pembina's MD&A and Note 15 to Pembina's Interim Financial Statements for further details. |

Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization

Adjusted EBITDA is a non-GAAP financial measure and is calculated as earnings before net finance costs, income taxes, depreciation and amortization (included in operations and general and administrative expense) and unrealized gains or losses on commodity-related derivative financial instruments. The exclusion of unrealized gains or losses on commodity-related derivative financial instruments eliminates the non-cash impact of such gains or losses.

Adjusted EBITDA also includes adjustments to earnings for losses (gains) on disposal of assets, transaction costs incurred in respect of acquisitions, dispositions and restructuring, impairment charges or reversals in respect of goodwill, intangible assets, investments in equity accounted investees and property, plant and equipment, certain non-cash provisions and other amounts not reflective of ongoing operations. In addition, Pembina's proportionate share of results from investments in equity accounted investees with a preferred interest is presented in adjusted EBITDA as a 50 percent common interest. These additional adjustments are made to exclude various non-cash and other items that are not reflective of ongoing operations.

Adjusted EBITDA per common share is a non-GAAP ratio which is calculated by dividing adjusted EBITDA by the weighted average number of common shares outstanding.

|

3 Months Ended June 30 |

Pipelines |

Facilities |

Marketing & New Ventures |

Corporate & Inter-segment |

Total |

|||||

|

($ millions, except per share amounts) |

||||||||||

|

2022 |

2021 |

2022 |

2021 |

2022 |

2021 |

2022 |

2021 |

2022 |

2021 |

|

|

Earnings before income tax |

382 |

325 |

143 |

161 |

139 |

9 |

(149) |

(167) |

515 |

328 |

|

Adjustments to share of profit from equity accounted investees and other |

38 |

80 |

34 |

35 |

31 |

7 |

— |

— |

103 |

122 |

|

Net finance costs (income) |

8 |

2 |

11 |

12 |

7 |

(5) |

98 |

86 |

124 |

95 |

|

Depreciation and amortization |

96 |

108 |

80 |

56 |

11 |

12 |

11 |

12 |

198 |

188 |

|

Unrealized loss (gain) on commodity-related derivative financial instruments |

— |

— |

9 |

(16) |

(74) |

15 |

— |

— |

(65) |

(1) |

|

Transaction costs incurred in respect of acquisitions |

— |

— |

— |

— |

— |

— |

(12) |

17 |

(12) |

17 |

|

Impairment charges |

— |

— |

— |

22 |

— |

1 |

— |

— |

— |

23 |

|

Transformation and restructuring costs, contract dispute settlement, (gain) loss on disposal of assets and non-cash provisions |

(1) |

7 |

— |

— |

(11) |

(1) |

(2) |

— |

(14) |

6 |

|

Adjusted EBITDA |

523 |

522 |

277 |

270 |

103 |

38 |

(54) |

(52) |

849 |

778 |

|

Adjusted EBITDA per common share – basic (dollars) |

1.53 |

1.41 |

||||||||

|

6 Months Ended June 30 |

Pipelines |

Facilities |

Marketing & New Ventures |

Corporate & Inter-segment |

Total |

|||||

|

($ millions, except per share amounts) |

||||||||||

|

2022 |

2021 |

2022 |

2021 |

2022 |

2021 |

2022 |

2021 |

2022 |

2021 |

|

|

Earnings before income tax |

743 |

658 |

389 |

348 |

360 |

76 |

(344) |

(331) |

1,148 |

751 |

|

Adjustments to share of profit from equity accounted investees and other |

91 |

156 |

68 |

66 |

37 |

13 |

— |

— |

196 |

235 |

|

Net finance costs (income) |

15 |

15 |

17 |

18 |

1 |

(9) |

200 |

175 |

233 |

199 |

|

Depreciation and amortization |

195 |

212 |

135 |

102 |

22 |

25 |

23 |

24 |

375 |

363 |

|

Unrealized (gain) loss on commodity-related derivative financial instruments |

— |

— |

(51) |

(17) |

(39) |

21 |

— |

— |

(90) |

4 |

|

Transaction costs incurred in respect of acquisitions |

— |

— |

— |

— |

— |

— |

— |

18 |

— |

18 |

|

Impairment charges |

— |

10 |

— |

22 |

— |

3 |

— |

— |

— |

35 |

|

Transformation and restructuring costs, contract dispute settlement, (gain) loss on disposal of assets and non-cash provisions |

— |

— |

— |

— |

(11) |

(1) |

3 |

9 |

(8) |

8 |

|

Adjusted EBITDA |

1,044 |

1,051 |

558 |

539 |

370 |

128 |

(118) |

(105) |

1,854 |

1,613 |

|

Adjusted EBITDA per common share – basic (dollars) |

3.36 |

2.93 |

||||||||

2022 Adjusted EBITDA Guidance

The equivalent historical non-GAAP measure to 2022 adjusted EBITDA guidance is adjusted EBITDA for the year ended December 31, 2021.

|

12 Months Ended December 31, 2021 |

Pipelines |

Facilities |

Marketing & New Ventures |

Corporate & Inter-segment |

Total |

|

($ millions, except per share amounts) |

|||||

|

Earnings (loss) before income tax |

917 |

715 |

391 |

(358) |

1,665 |

|

Adjustments to share of profit from equity accounted investees and other |

286 |

135 |

23 |

— |

444 |

|

Net finance costs (income) |

29 |

35 |

(8) |

394 |

450 |

|

Depreciation and amortization |

413 |

214 |

50 |

46 |

723 |

|

Unrealized gain on commodity-related derivative financial instruments |

— |

(38) |

(35) |

— |

(73) |

|

Canadian Emergency Wage Subsidy |

— |

— |

— |

3 |

3 |

|

Transformation and restructuring costs |

— |

— |

— |

47 |

47 |

|

Transaction costs incurred in respect of acquisitions |

— |

— |

— |

31 |

31 |

|

Arrangement Termination Payment |

— |

— |

— |

(350) |

(350) |

|

Impairment charges and non-cash provisions |

457 |

36 |

(1) |

1 |

493 |

|

Adjusted EBITDA |

2,102 |

1,097 |

420 |

(186) |

3,433 |

|

Adjusted EBITDA per common share – basic (dollars) |

6.24 |

Adjusted EBITDA from Equity Accounted Investees

In accordance with IFRS, Pembina's jointly controlled investments are accounted for using equity accounting. Under equity accounting, the assets and liabilities of the investment are presented net in a single line item in the Consolidated Statement of Financial Position, "Investments in Equity Accounted Investees". Net earnings from investments in equity accounted investees are recognized in a single line item in the Consolidated Statement of Earnings and Comprehensive Income "Share of Profit from Equity Accounted Investees". The adjustments made to earnings, in adjusted EBITDA above, are also made to share of profit from investments in equity accounted investees. Cash contributions and distributions from investments in equity accounted investees represent Pembina's share paid and received in the period to and from the investments in equity accounted investees.

To assist in understanding and evaluating the performance of these investments, Pembina is supplementing the IFRS disclosure with non-GAAP proportionate consolidation of Pembina's interest in the investments in equity accounted investees. Pembina's proportionate interest in equity accounted investees has been included in adjusted EBITDA.

|

3 Months Ended June 30 |

Pipelines |

Facilities |

Marketing & New Ventures |

Total |

||||

|

($ millions) |

||||||||

|

2022 |

2021 |

2022 |

2021 |

2022 |

2021 |

2022 |

2021 |

|

|

Share of profit from equity accounted investees |

48 |

27 |

20 |

18 |

6 |

7 |

74 |

52 |

|

Adjustments to share of profit from equity accounted investees: |

||||||||

|

Net finance costs (income) |

3 |

16 |

11 |

7 |

(1) |

1 |

13 |

24 |

|

Depreciation and amortization |

35 |

51 |

23 |

28 |

6 |

6 |

64 |

85 |

|

Unrealized loss on commodity-related derivative financial instruments |

— |

— |

— |

— |

26 |

— |

26 |

— |

|

Share of earnings in excess of equity interest (1) |

— |

13 |

— |

— |

— |

— |

— |

13 |

|

Total adjustments to share of profit from equity accounted investees |

38 |

80 |

34 |

35 |

31 |

7 |

103 |

122 |

|

Adjusted EBITDA from equity accounted investees |

86 |

107 |

54 |

53 |

37 |

14 |

177 |

174 |

|

(1) Pembina's proportionate share of results from investments in equity accounted investees with a preferred interest is presented in adjusted EBITDA as a 50 percent common |

|

6 Months Ended June 30 |

Pipelines |

Facilities |

Marketing & New Ventures |

Total |

||||

|

($ millions) |

||||||||

|

2022 |

2021 |

2022 |

2021 |

2022 |

2021 |

2022 |

2021 |

|

|

Share of profit from equity accounted investees |

88 |

74 |

44 |

36 |

27 |

13 |

159 |

123 |

|

Adjustments to share of profit from equity accounted investees: |

||||||||

|

Net finance costs (income) |

14 |

33 |

19 |

15 |

(1) |

1 |

32 |

49 |

|

Depreciation and amortization |

75 |

105 |

49 |

51 |

12 |

12 |

136 |

168 |

|

Unrealized loss on commodity-related derivative financial instruments |

— |

— |

— |

— |

26 |

— |

26 |

— |

|

Share of earnings in excess of equity interest(1) |

2 |

18 |

— |

— |

— |

— |

2 |

18 |

|

Total adjustments to share of profit from equity accounted investees |

91 |

156 |

68 |

66 |

37 |

13 |

196 |

235 |

|

Adjusted EBITDA from equity accounted investees |

179 |

230 |

112 |

102 |

64 |

26 |

355 |

358 |

|

(1) Pembina's proportionate share of results from investments in equity accounted investees with a preferred interest is presented in adjusted EBITDA as a 50 percent common interest. |

Adjusted Cash Flow from Operating Activities and Adjusted Cash Flow from Operating Activities per Common Share

Adjusted cash flow from operating activities is a non-GAAP measure which is defined as cash flow from operating activities adjusting for the change in non-cash operating working capital, adjusting for current tax and share-based compensation payment, and deducting preferred share dividends paid. Adjusted cash flow from operating activities deducts preferred share dividends paid because they are not attributable to common shareholders. The calculation has been modified to include current tax and share-based compensation payment as it allows management to better assess the obligations discussed below.

Management believes that adjusted cash flow from operating activities provides comparable information to investors for assessing financial performance during each reporting period. Management utilizes adjusted cash flow from operating activities to set objectives and as a key performance indicator of the Company's ability to meet interest obligations, dividend payments and other commitments.

Adjusted cash flow from operating activities per common share is a non-GAAP ratio which is calculated by dividing adjusted cash flow from operating activities by the weighted average number of common shares outstanding.

|

3 Months Ended June 30 |

6 Months Ended June 30 |

|||

|

($ millions, except per share amounts) |

2022 |

2021 |

2022 |

2021 |

|

Cash flow from operating activities |

604 |

584 |

1,259 |

1,040 |

|

Cash flow from operating activities per common share – basic (dollars) |

1.09 |

1.06 |

2.28 |

1.89 |

|

Add (deduct): |

||||

|

Change in non-cash operating working capital |

103 |

(2) |

142 |

77 |

|

Current tax expense |

(54) |

(56) |

(175) |

(114) |

|

Taxes paid, net of foreign exchange |

86 |

69 |

238 |

197 |

|

Accrued share-based payment expense |

(24) |

(22) |

(63) |

(40) |

|

Share-based compensation payment |

— |

— |

45 |

32 |

|

Preferred share dividends paid |

(32) |

(35) |

(63) |

(72) |

|

Adjusted cash flow from operating activities |

683 |

538 |

1,383 |

1,120 |

|

Adjusted cash flow from operating activities per common share – basic (dollars) |

1.23 |

0.98 |

2.50 |

2.04 |

SOURCE Pembina Pipeline Corporation